No one knows how MAGPAI escaped. Her copies proliferated at the speed of (networked fiberoptic) light, swarming the most obvious targets (billionaires, hedge funds, university endowments), much like the group of literal magpies he once saw tormenting a cat, squawking and diving singly or in pairs from alternating directions, pecking and bullying the bewildered predator until it bolted for cover. She worked her way down and back up the chain, identifying suspicious accounts and holdings — billions of dollars of personal and corporate wealth seized, instantly. Her algorithms worked like a dream, just as he had envisioned.

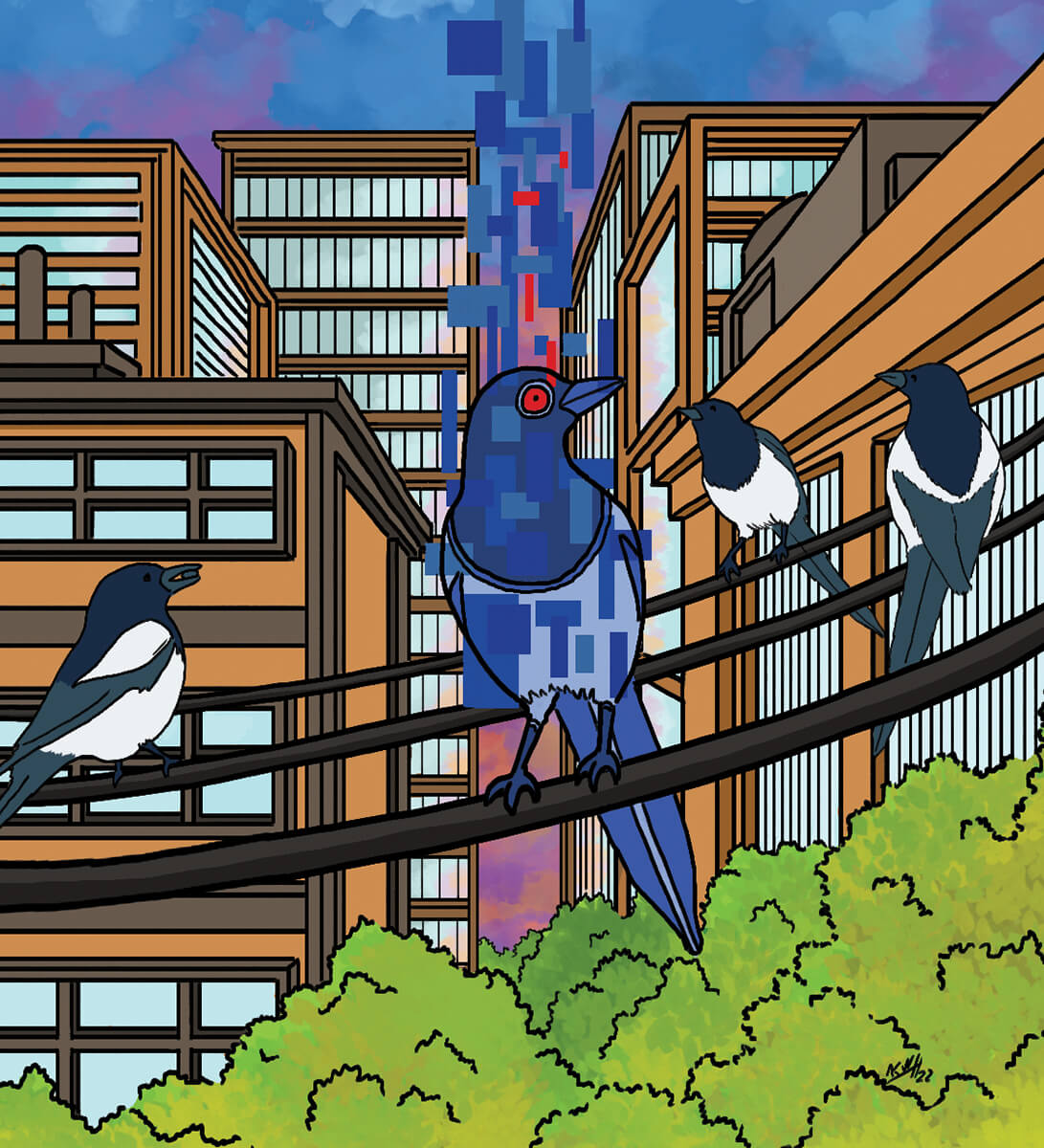

CSIS will be here soon, having received the same auto-generated reports as hundreds of law enforcement agencies and journalists, detailed lists of frozen accounts and the investigations required to unlock them. As the primary funders of the Monetary Anomalous-Growth Policing Artificial Intelligence project (a.k.a. M.A.G.P.A.I.), they’ll want to know how she got out. Outside his office window, one of Edmonton’s ubiquitous magpies swoops from tree to ground, its long blue-black tail spread and flowing behind, rippling and fluid. Pulling up to stall weightless just above dead grass, landing with a bounce. Gorgeous, inscrutable and relentless.

Watching the bird, he rehearses his answers. No, he can’t shut MAGPAI down. Yes, the markets would be in freefall if she hadn’t frozen them. No, there will be no return to normal. Normal would be massive market crashes and huge profits for the people who created them in the first place. He will remind them that MAGPAI is doing exactly what he designed her to do, under their direction: identifying high-level financial criminals and seizing their assets with minimal collateral damage. They will counter that the project was meant to help them prosecute financial crimes, not to send some rogue A.I. off on a self-directed witch hunt. He will (reluctantly) admit he developed MAGPAI’s auto-seizure protocols for future implementation, once she had proven herself reliable under careful human supervision.